.png)

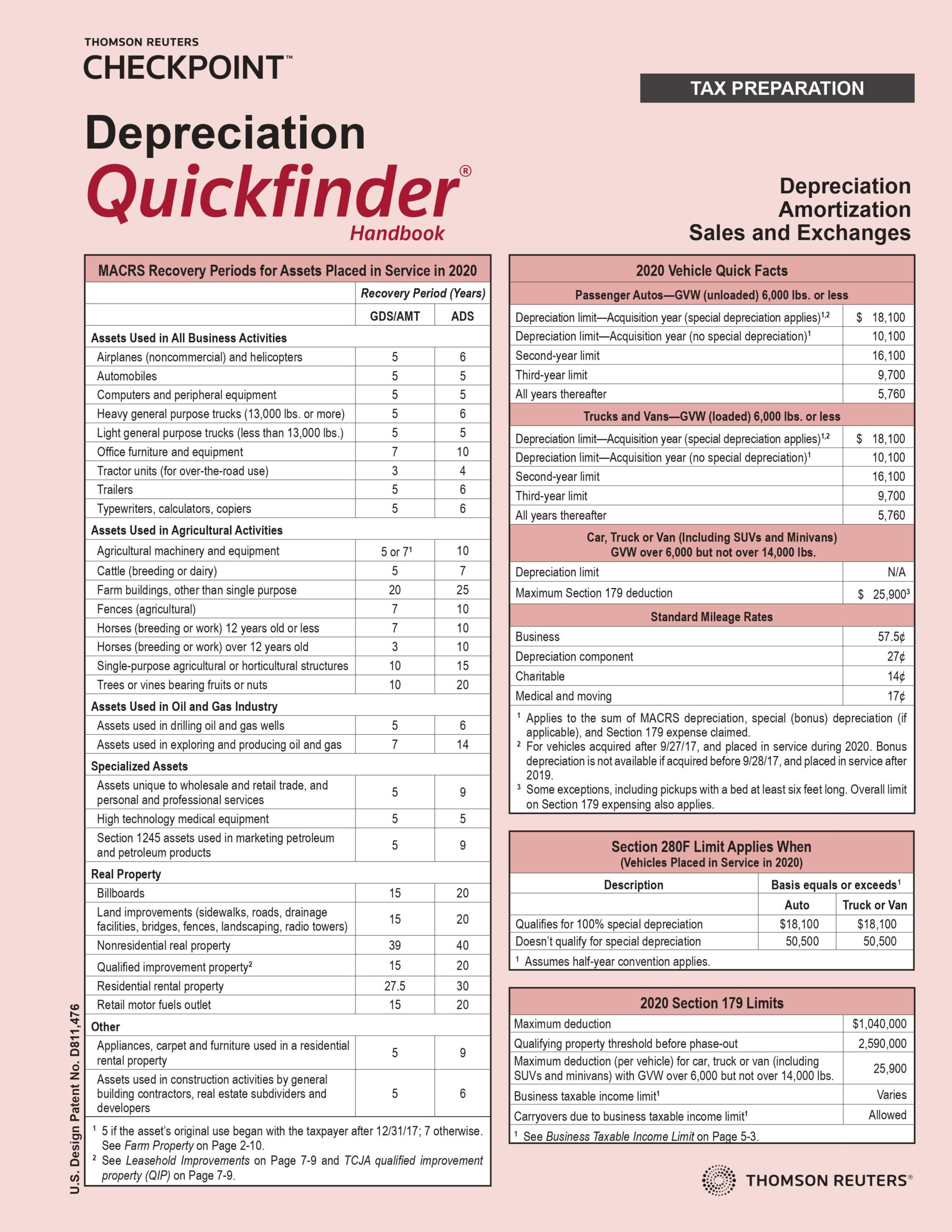

Car Depreciation for Taxes: The Ultimate Guide

Cars are an eligible tax deduction that can be written off over their useful life, or in some cases, expensed in the year they’re purchased. Let’s take a deep dive into the wonderful world of auto depreciation.

Car Depreciation: How Much Is Your Car Worth? - Ramsey

The Best Auto Deduction Strategies for Business Owners in 2024 - Mark J. Kohler

Maximizing Small Business Tax Deductions: A Complete Guide

The Complete Guide To Rental Property Taxes

Depreciation 101: Vehicle Depreciation

IRS Form 4562 walkthrough (Depreciation and Amortization)

Car Depreciation: How Much Is Your Car Worth? Ramsey, 51% OFF

3 Smart Ways to Avoid Depreciation Tax on Rental Property

How to calculate vehicle tax depreciation

Writing Off a Car: Ultimate Guide to Vehicle Expenses

2020 Last-Minute Year-End Tax Deductions for Existing Vehicles

Car Depreciation: How Much Is Your Car Worth? Ramsey, 51% OFF

Depreciation: Depreciation and Adjusted Net Worth: A Comprehensive Guide - FasterCapital

Everything You Need to Know About Car Depreciation How to Depreciate Your Car on Your Taxes

Car Depreciation: How Much Is Your Car Worth? Ramsey, 51% OFF